Humira, a top-selling drug with $200 billion in revenue over two decades, recently lost its patent monopoly. This paved the way for biosimilars like Amjevita to enter the market and offer more affordable treatment options. However, when Amgen launched Amjevita in the US, it had two list prices, $40,500 (55% below the current Humira list price of $90,000/year) and $85,494 (5% below the current Humira list price)1,2.

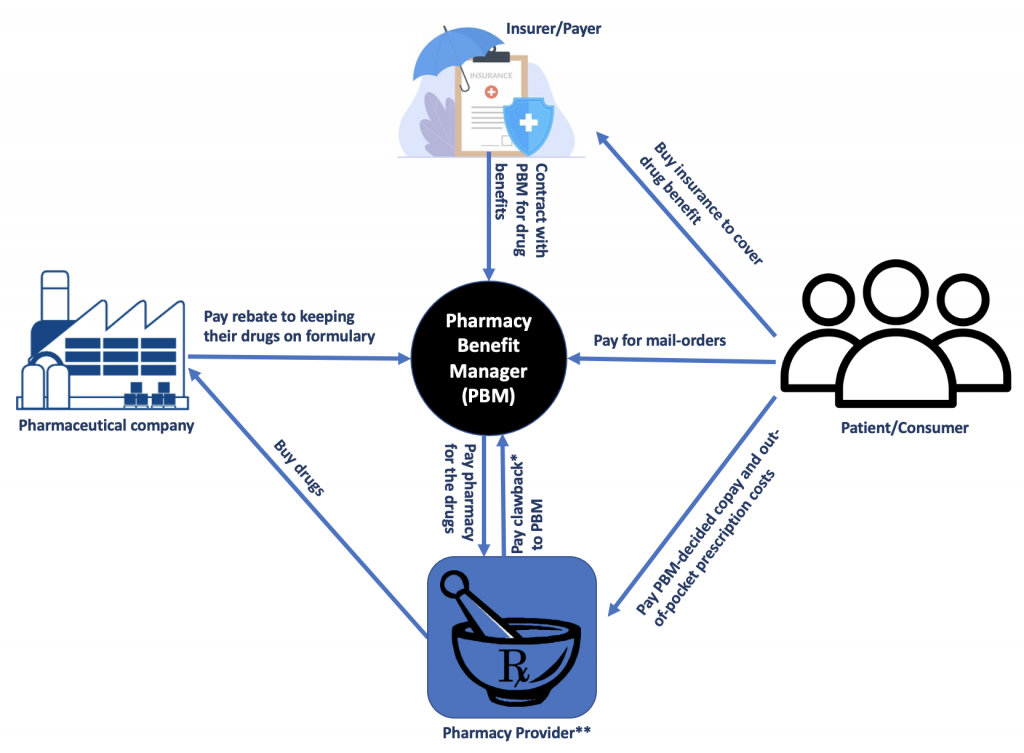

So, does the drug have a premium version and basic version like Netflix? The answer is no. It’s the same drug with two different list prices. But why? To answer this question, we need to look at the complex system of pharmacy benefit management in the US (see Figure 1).

Insurers and payers such as commercial health plans, self-insured employer plans, federal and state governments (for Medicare Part D plans, the Federal Employees Health Benefits Program, state government employee plans, managed Medicaid plans) contract with pharmacy benefit managers (PBM) to manage the pharmacy benefits. PBMs are intermediaries between drug manufacturers, insurers, and patients. PBMs develop and maintain lists, or formularies, of covered medications on behalf of health insurers, which influence which drugs individuals use and determine out-of-pocket costs. In addition, they use their purchasing power to negotiate rebates and discounts from drug manufacturersand contract directly with individual pharmacies to reimburse for drugs dispensed to beneficiaries.

However, PBMs are not without controversy. They may have an incentive to favor high-priced drugs over cost-effective ones, because they receive a larger rebate for expensive drugs3. This can result in higher out-of-pocket costs for patients who have high-deductible plans or copays based on a drug’s list price. In the case of Amjevita, Amgen offered a straightforward lower price of $40,494 each year to buyers who don’t want to negotiate rebates. However, if a PBM-like buyer wants a rebate, Amgen charges the much higher price4.

PBMs defend themselves by arguing that they pass through the rebates to insurers and payers to further reduce people’s premiums and cost-sharing payments. However, many small insurers and employers say they do not receive this share of savings3. The lack of transparency around PBM rebate practices has led to calls for greater oversight and regulation of the industry.

So pharmaceutical manufacturers criticize PBMs for driving up drug prices by demanding high rebates. Pharmacies also complain about PBM contracts that include unfavorable conditions and clawback fees, which occur when a PBM recoups some of its payments to pharmacists for certain drugs. Some insurers and payers say they do not receive any pass-through sharing of the rebates and clawback fees.

Today, there are 66 PBM companies, with the three largest—Express Scripts, CVS Caremark, and OptumRx—controlling approximately 89% of the market and serving about 270 million Americans5. This level of consolidation has raised concerns about antitrust violations and reduced competition in the marketplace. Congress is actively investigating how PBMs affect drug prices and what can be done to make the system more transparent and accountable6-10.

The lack of transparency around PBM rebate practices has led to calls for greater oversight and regulation of the industry. Patients, healthcare providers, and insurers all have a stake in this issue, as it impacts the accessibility and affordability of healthcare in the US. As the healthcare industry continues to evolve, it is crucial to understand the role of all stakeholders and advocate for a fair and transparent system.

Reference:

- https://www.amgen.com/newsroom/press-releases/2023/01/amjevita-adalimumabatto-first-biosimilar-to-humira-now-available-in-the-united-states

- https://www.bloomberg.com/news/articles/2023-01-31/amgen-takes-on-blockbuster-drug-humira-with-biosimilar-as-much-as-55-cheaper

- https://www.commonwealthfund.org/publications/explainer/2019/apr/pharmacy-benefit-managers-and-their-role-drug-spending

- https://www.bloomberg.com/news/newsletters/2023-02-14/an-unusual-pricing-strategy-for-a-new-version-of-an-old-drug

- https://content.naic.org/cipr-topics/pharmacy-benefit-managers#:~:text=Today%2C%20there%20are%2066%20PBM,of%20UnitedHealth%20Group%20Insurance)%20%E2%80%93%20controlling

- https://www.fiercehealthcare.com/payers/senators-introduced-bills-reform-pbms-after-stalling-out-last-congress

- https://www.fiercehealthcare.com/payers/senators-question-why-pbms-even-exist-heated-hearing-amid-push-reform

- https://rollcall.com/2023/01/26/drug-company-middlemen-likely-to-be-a-focus-in-118th-congress/

- https://www.wsj.com/articles/drug-prices-investigation-focused-on-middlemen-opens-in-congress-f5a7fd25

- https://www.washingtonpost.com/politics/2023/01/13/lawmakers-are-readying-fresh-attacks-pharmacy-middlemen/

0 Comments